Last month, President Joe Biden announced that students around the country can continue to temporarily stop payments on their federal student loans, a decision that will allow students at the University of Minnesota greater financial flexibility in the coming months.

Originally introduced by the U.S. government at the onset of the COVID-19 pandemic, this payment pause has been extended several times in the past two years. The U.S. Department of Education announced Dec. 22 that the student loan pause was extended for 90 days, until May 1.

Biden’s statement said the extension of the pause will give borrowers “badly-needed breathing room during the economic upheaval caused by the global COVID-19 pandemic.”

The loan pause mostly impacts students with unsubsidized loans, as they begin collecting interest while the student is in school. For students with subsidized loans, which do not begin collecting interest until post-graduation, the pause may not be as beneficial, according to Tom Schmidt, the University’s Office of Student Finance associate director for student account assistance.

“Enrolled students with unsubsidized direct loans can see a benefit of no interest being assessed, as would normally happen, and will resume as of May 1,” Schmidt said in an email to the Minnesota Daily.

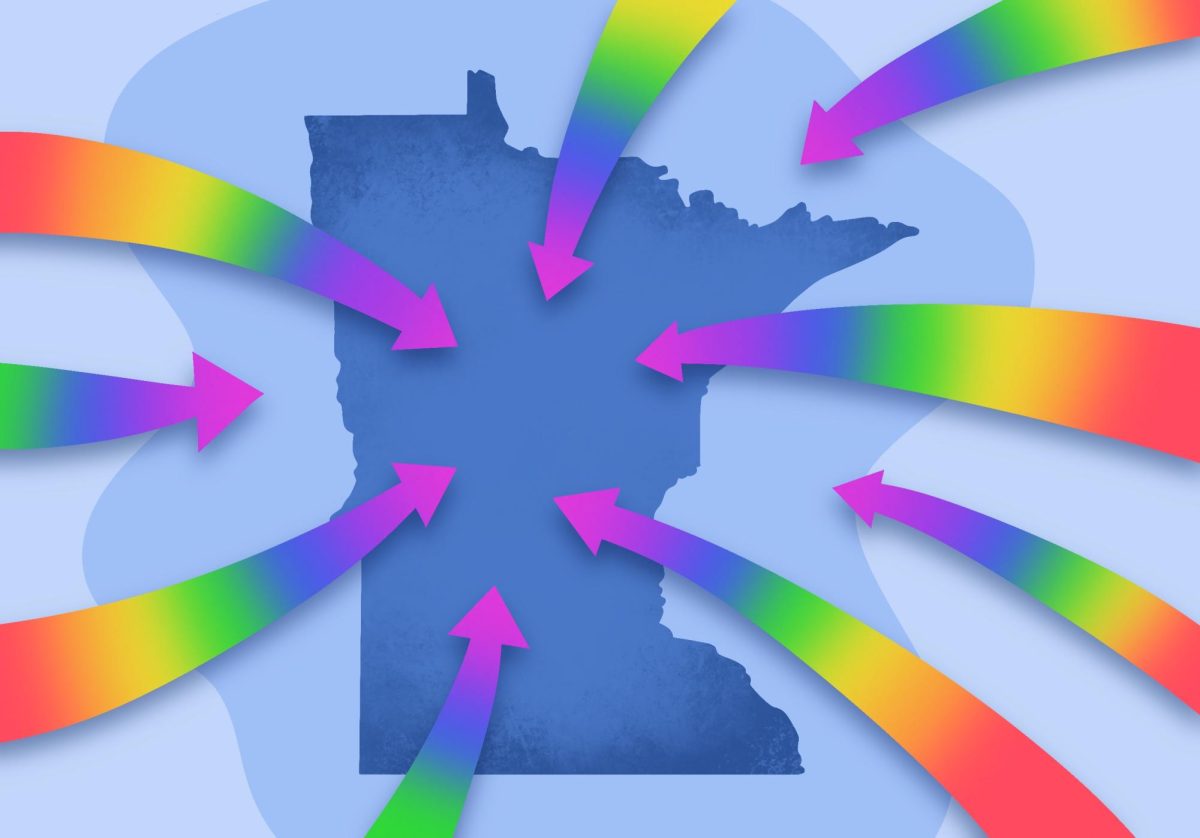

The total outstanding student debt in Minnesota is currently $29 billion. There are currently about 900,000 student loan borrowers in Minnesota, each oweing approximately $31,250 on federal and private student loans, said Andrew Pentis, a certified student loan counselor and debt expert from Student Loan Hero.

“[Borrowers] can make the election to make voluntary payments if they want to on their payments and that could be beneficial for them and then obviously, for borrowers who are out of school this is even more of a help, because they may have higher interest rates on their federal loans than current students do,” Pentis said.

Third-year University student Karri Seland said she typically borrows $10,000 each year in both private and public loans to help pay her tuition.

Seland said the pauses have been necessary to relieve the financial stress brought about by the COVID-19 pandemic. Seland said she thinks the initial pause in March 2020 was more beneficial to her than the most recent extension.

“I think it benefited me more right away than it does now,” Seland said. “Right now I’m making payments on it even though it’s still paused and not required for me to do, because I don’t want to be in debt for a really long time after I graduate.”

Seland said the pause extension has created a sense of financial security and freedom, in case there are circumstances where she may need or want to miss a payment on her loans.

“If I had an extra expense come up, like ‘Oh, I need my oil changed,’ I can just cut out that loan payment because I don’t have to pay it,” Seland said. “If something goes wrong, I know that I have the money for it.”

Andrew Epperson, a University student on the Crookston campus, said the extension creates a sense of financial freedom and security for him. As a married father-of-two, Epperson said he will be able to work less hours and focus more on his classes.

“I’m a little bit older than the conventional student, but starting life is hard, and a few hundred dollars a month for a few months [helps],” Epperson said. “[Being able to pay] a couple rent payments or mortgage payments or for a night out on the town – that’s important too for life.”

Epperson said his family is currently paying off his wife’s student loan debt, and are now able to focus on repaying unsubsidized loans and additional loans at their own pace.

“I think [the pause] was needed, the last couple years were tough for everyone,” Epperson said. “Even if somebody wasn’t necessarily impacted directly financially, [it’s] one less thing for everyone.”

Pentis suggests currently enrolled students take advantage of the 0% interest rate to continue paying off their debt now, if they are able.

“Even by paying a little bit of money towards your student loans while you’re in school, say $25 a month, which equates to maybe keeping a new pair of jeans or skipping a couple dinners out,” Pentis said. “Submitting that towards your loans can help you ensure that when you graduate, you’re not staring at a much larger balance than you originally borrowed.”

Currently enrolled University students can utilize One Stop Student Services’s financial resources for guidance on student loans, according to University spokesperson Andria Waclawski.

“The only real con I can imagine is this [pause] sort of gives borrowers a sense of, ‘Everything’s gonna be fine. I don’t need to make a plan,’ and that’s absolutely not the case,” Pentis said. “It gives borrowers some time to focus on other goals in their personal finances … but those borrowers should still make a plan going forward for how they will resume their repayment.”

A Gopher

Jan 22, 2022 at 10:10 am

I think recent presidents from both parties have really let the average American. Obama and Biden, as you’ve outlined. And Trump for his open grifting and massive amounts of our tax money going to businesses that don’t have to show any accounting for what happens to that money. We really need a true fiscally responsible, practical people’s party, the PPP!

CapnRusty

Jan 22, 2022 at 12:43 am

When you borrow money for college, you should pay it back. It used to be, before Obama, that you borrowed the money from a bank, and the money that was in the bank came from depositors. The government guaranteed a portion of your loan in case you didn’t pay it back to the bank, like you said you would when you got the money. But the bank would lose some of its depositor’s money if you didn’t pay it back, so they usually required you to live up to your agreement. But after the government took over student lending (under Obama), the money you were borrowing was taxpayer’s money. You may have noticed, taxpayers tend to get shafted by the government. So Joe Biden has decided to let you off the hook for the money you borrowed from the taxpayers. Certainly, you should be able to see that he’s buying your vote. You know you should really pay back that money, for the simple reason that you said you would. One of the great philosophers (Kant, I think) said you should conduct your life in such manner that you would be happy to live in a place where everyone else conduct their lives in the same manner. Think about that while you’re enjoying your free money.