Deborah Gorman was shocked when she got her property tax assessment from Minneapolis and Hennepin County.

The combined total of the 2011 levies hike her property taxes up an estimated 16.2 percent âÄì which is about $1000 more over this year, even though her property has lost 25 percent of its value in recent years.

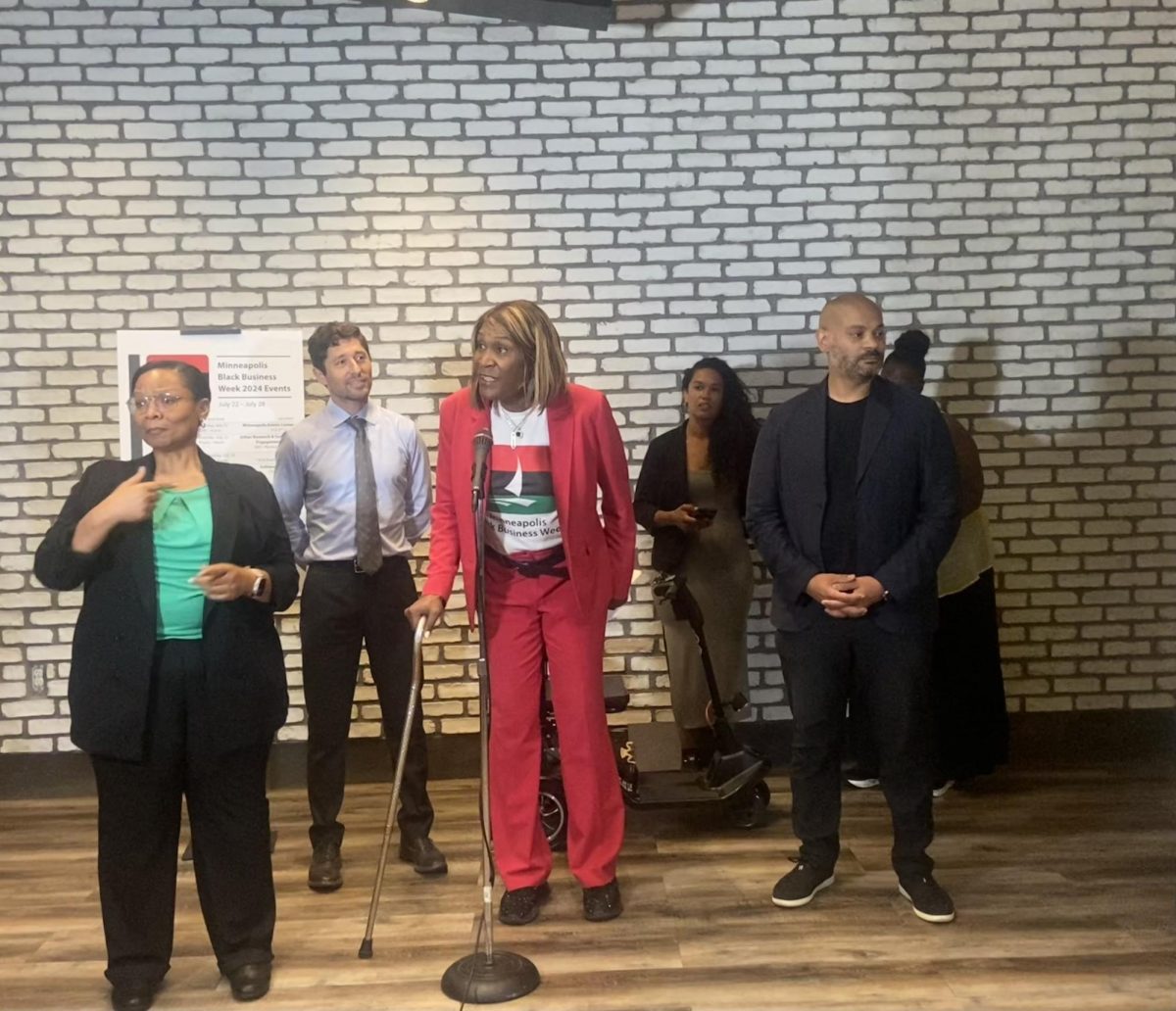

Gorman was just one of the many Minneapolis residents who packed into the City Council session Thursday evening to voice their concerns about the 2011 budget and how it will be paid for.

The upcoming budget for Minneapolis is at a proposed $1.36 billion, with about 42 percent of funds coming from property tax.

Gorman was among the most outspoken of the residents who spoke before the council. She said the city must reconsider spending money.

âÄúItâÄôs a shameful thing for them to continue to spend money to that extent and put that kind of burden on overburdened households,âÄù she said.

Mayor R.T. Rybak spoke briefly throughout the hearing, apologizing to residents and saying Minneapolis residents should be angry.

âÄúPeople are plenty pissed off, and they should be,âÄù Rybak said to a group of residents after the session was adjourned.

He added that most of the budget couldnâÄôt be cut without sacrificing public safety and roads, which make up a significant portion of budget.

Melissa Paulson, another citizen who spoke before the council, said she lost her job about a month ago and said the 17.9 percent increase in property taxes she paid âÄúwas rudeâÄù.

âÄúIâÄôm hoping you can rethink and address the situation so that I donâÄôt end up homeless,âÄù Paulson said, near tears.

Other residents echoed the same sentiment and said they would likely have to pack up and leave for the suburbs, with a few seeing property tax increases as high as 35 percent. Most were seeing an increase of 10 percent to 20 percent.

Another concern frequently mentioned was that residents received their property tax estimations Wednesday âÄì just a day before the public hearing.

Council members and Rybak were quick to point out that the city has no control over when the documents are sent and that the duty falls into the hands of Hennepin County.

Much of the property tax increases come because of increased pension obligations the city faces, City Council President Barbara Johnson said.

âÄúEvery penny of the 6.5 percent levy increase goes soley to pay for skyrocketing pensions costs,âÄù Johnson said.

JohnsonâÄôs words did little to sooth the crowd, which jeered and muttered throughout the hearing.

The 6.5 percent was RybakâÄôs proposed levy increase, but the documents sent to residents showed 7.5 percent. The extra percentage point was added in case the city sees drastic cuts from state aid, but Rybak said barring the most austere cuts, itâÄôs like that the 6.5 percent levy would suffice.

In order to lower property taxes, Gorman said sheâÄôd like to see everything except public safety scrutinized.

She called the park board âÄúexcessiveâÄù and said, âÄúFire and police have to be supported, but other than that, I think every non-essential service should be minimized âĦ or be eliminated.âÄù

Gorman said that even with the residentsâÄô pleas, itâÄôs unlikely that the city will reduce the property tax burden.

She said the only solution to the problem was to stop spending money.

âÄú[The city] spends too much money,âÄù Gorman said. âÄúWhatever your budget is âĦ if your expenses increase you have to do something else to decrease to make up for it. And instead they just come after more money.âÄù