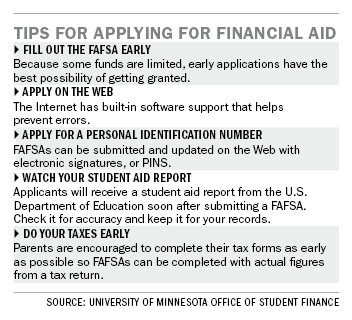

When Bridget Babcock , a communications sophomore, filled out the Free Application for Federal Student Aid she found it frustrating, the U.S. Department of Education is trying to help simplify the process. The six-page form, with over 100 question s took her longer than the hour the government said it should take to fill out. âÄúIt took hours upon hours, upon hours,âÄù she said. âÄúItâÄôs so much information that they needed. I understand why they need it, but it is frustrating to give it out.âÄù With the widespread aggravation of students and their families in mind, the Education Department has begun researching ways to simplify the form. This could include reducing the number of data elements asked for and calculating need based on a simple adjusted gross income formula, or by using income and other data the Internal Revenue Service already collects, department spokeswoman Jane Glickman said in an e-mail. Babcock isnâÄôt the only one who finds the process daunting. Michelle Overtoom , a University of Minnesota One Stop Counselor âîÄ who is one of the contacts for financial aid questions âîÄ said parents of first-year students often call with question about filling out sections on assets and household members, especially from January through May, when the majority of families are filling out the form. The Education Department is also discussing options with the U.S. Department of the Treasury and the Office of Management and Budget , she said. Though President Barack Obama promised during his campaign to do away with the form all together, it is still unclear if that will actually happen. For now, the Education Department is researching different ways to streamline the process with the Obama administrationâÄôs support, Glickman said. If aid were calculated based on familiesâÄô tax returns and not the FAFSA, the change would be subject to congressional approval. But with simplification comes risk, Glickman said. According to Glickman, using fewer data elements to calculate studentsâÄô financial needs could result in people appearing to be âÄúlow-incomeâÄù when they actually have resources to pay for college. Glickman said using IRS data could also be a problem because some low-income families do not file tax returns. For the option to be feasible the government would need an alternative source of data. âÄúWe need to make sure the form doesnâÄôt oversimplify the process and result in aid not being targeted to the low-income people we are trying to reach,âÄù she said in the e-mail. Deb Pusari , the associate director of the Office of Financial Aid at the University of Minnesota, said the initiative to simplify financial aid would be good for students and their families, but she also acknowledged the risk. Simplification gives a less precise reflection of diverse families, such as families consisting of divorcees and multiple incomes, Pusari said. Even Babcock acknowledges the current format is probably useful, though she would still like to see it simplified. For now, however, parents and students will have to make do with the long form. Pusari encourages parents and students at the University of Minnesota to come to the financial aid department with any questions or concerns. The department reaches over 10,000 people through presentations, which explain the application process, but 21,000 students have still not completed the FAFSA for next year, Pusari said. âÄúI think just looking at it sometimes seems overwhelming,âÄù Pusari said. âÄúWhen you actually get into [completing] the questions it might not be as difficult.âÄù The final FAFSA deadline for 2008-2009, is in June.

Image by Ashley Goetz

Feds consider FAFSA simplification

Pros and cons make the current form difficult to renovate.

Published April 5, 2009

0

More to Discover