Several small businesses near the University of Minnesota received loans meant to aid COVID-19 economic recovery.

Seventeen Cedar-Riverside businesses each received $10,000 from the city of Minneapolis through a loan program meant to help sustain business through the pandemic. The loans, which were provided citywide to businesses in cultural districts and low-income areas, gave much-needed aid during a time of uncertainty, business owners said.

“Feeling the system backing up … small business is — both psychologically and, of course, materially is — an important thing for us,” said Faruk Cingilli, owner of Campus Cafe, a Turkish restaurant on the West Bank.

The loans come from a $2.2 million pool of city funds. Eligibility is limited to businesses that are located in designated cultural districts or zones already targeted for aid and that also have 20 employees or less or make less than $1 million in annual revenue. Self-employed business owners are also eligible.

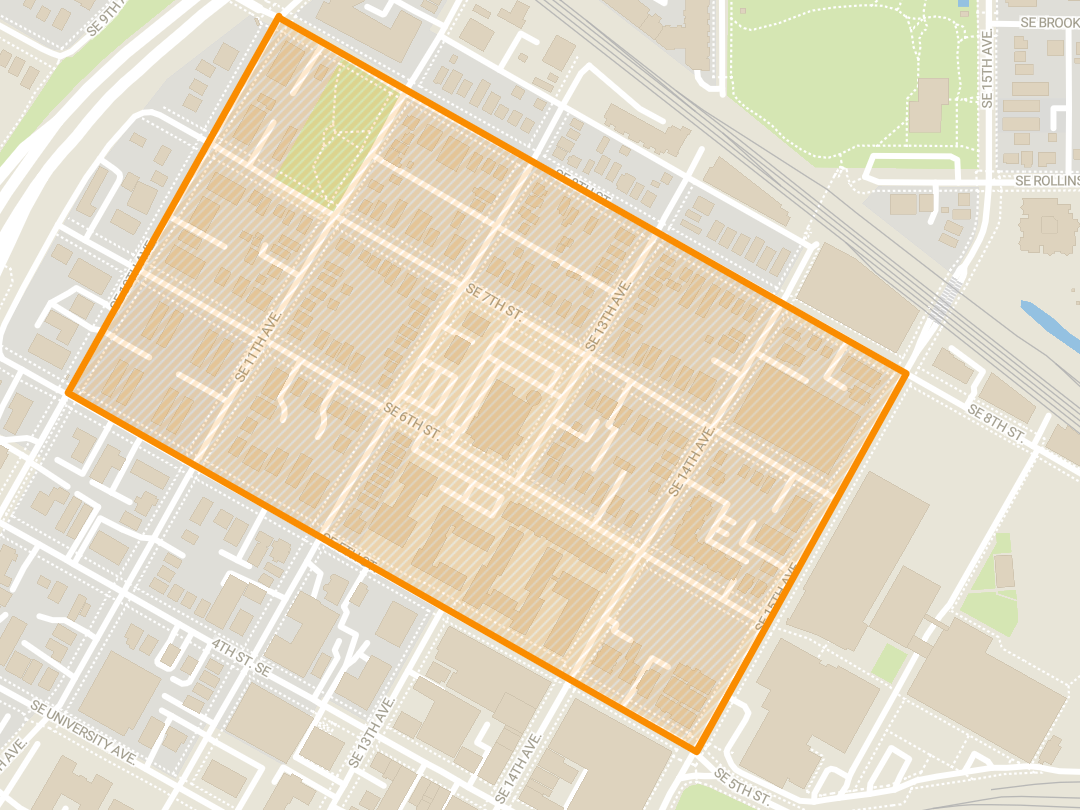

Neighborhoods eligible for the loans near the University include Cedar-Riverside, Seward and Ventura Village. The Cedar-Riverside neighborhood received the second-highest number of loans in the city behind the Central neighborhood in south Minneapolis.

The loans are forgivable, meaning that with quarterly business updates, the loans will not need to be paid back, said Jim Terrell, program supervisor for the city’s participation loan programs.

“We just have enormous needs in the city of Minneapolis and very limited resources,” Terrell said. “More help is still needed.”

When the pandemic-related restrictions began ramping up in March and April, the city created “gap funding,” which aimed to provide additional aid where other government entities might fall short. The funding included both the small business loan program and aid for housing, which was geared toward low-income households.

Cultural districts and designated areas were chosen due to increased poverty levels in those areas compared to others in the city, Terrell said.

“They’re the areas that need the help most,” he said.

Cingilli said the money went toward paying Campus Cafe employees and keeping up with expenses like rent. He said he is hoping things turn around soon.

“We’re still kicking,” he said. “[We’re] hoping that we will be able to get more money to be able to stay open.”

Flamin Thai Cuisine, a Thai restaurant in Cedar-Riverside, also received the small business loans. Owner Noumay Sisomphan said while the business utilized takeout and delivery options, most of the revenue came from sit-down dining, which was no longer allowed. The loans helped relieve some financial pressure, she said.

Sisomphan said business has been OK, but she is trying to make sure it survives.

Small businesses like Campus Cafe have proven themselves to be a cornerstone of the economy, making them important to sustain, Cingilli said.

“The money invested in that sector, you know, the small business segment of economy … [it] has a tendency to trickle down the system to go to a higher rate of circulation through the economy,” he said.