A new small business loan from the city could give some University of Minnesota-area businesses the relief they need, but geographic limits will keep others from qualifying.

To help small businesses struggling financially from the COVID-19 pandemic, the city of Minneapolis launched a $2.2 million small business loan fund earlier this month. The no-payment, no-interest loans are completely forgiven after 12 months if the business continues to operate in good standing with the city. To qualify, businesses must have 20 or fewer employees or have an annual revenue of $1 million or less.

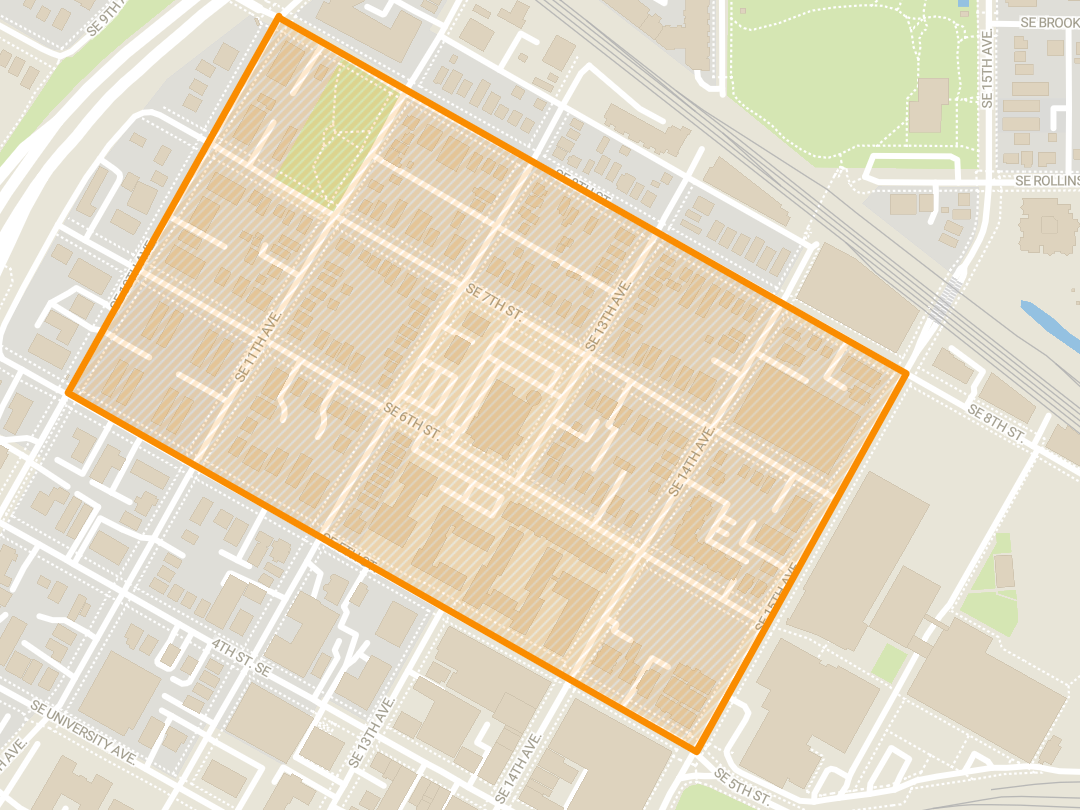

Qualifying businesses must also be located in city-defined areas, which includes Cedar-Riverside. University neighborhoods of Prospect Park, Southeast Como and Marcy-Holmes are not included.

“For businesses, we’re going to the businesses that are the smallest, least revenue and, at some point, the most on the brink,” Minneapolis Mayor Jacob Frey said at a remote City Council meeting Friday.

Ben Li owns the The Cajun House along University Avenue in Prospect Park. His business meets all of the criteria except the geographical requirements for the city’s forgivable loan program.

“We don’t understand why there is such a boundary because we also don’t pay less tax,” Li said.

He said if he were eligible for the forgivable loan program, he would use it to pay his staff so that they could come back and help ease some of the burden of running the restaurant solo. He has considered closing the restaurant for the time being, but he said he needs the limited revenue to keep it open.

“We’re only open a few hours a day, but that’s just enough to pay the rent,” he said. “We have the mortgage and car loan, insurance and school expenses.”

Li said he would like more outreach from local and federal level about other programs he can apply for so that he can make better informed decisions going forward.

In a statement to the Minnesota Daily, city spokesperson Mychal Vlatkovich said the city identified areas with the greatest need, like those with the highest rates of poverty, for the loans. Vlatkovich said the city does not have the resources to provide citywide loans. The city is also pushing for more federal and state support in an effort to cover the unmet needs of those affected financially by the pandemic.

Danny Schwartzman, board chair of Main Street Alliance’s Minnesota chapter, a national association of small businesses, said that he understands the effort to target specific areas of poverty and special assistance. But he said all businesses throughout the city have been affected.

“I get why we want to focus it on some particular corridors, but in a crisis that affects everyone everywhere, I don’t know why you might care if they’re one side of the street or another or some of the five tight geographic definitions.”

In addition to the forgivable loan program, the city launched a city-lender loan program available citywide, which Li could tap into. The program pairs lenders like local banks with borrowers, with the city matching a percentage of the lender’s loan.

Schwartzman said he worries that the city-lender loan application process could prove inaccessible for businesses without the resources or relationships to banks.

He said that the conventional banking industry has historically not worked well for business owners of color and groups with limited capital.

The city-lender loan program has the same requirements for employee number and total revenue as the forgivable loan program.

Simpls, another restaurant nearby, is also in a tough situation: co-founder Ryan Rosenthal said the business’ size makes it ineligible for both city and some federal lending programs.

“I’m just saying that it’s weird that we’re getting caught in a weird place where we’re just too big for this city program,” he said, “But, we’re way too small for … getting access to funding at the federal level.”

Applications for the city’s forgivable loans program close Monday at noon.

Jiang Li contributed to this report.