As the Minnesota State Legislature looks to craft its next biennial budget, lawmakers are scrambling to address last year’s unfinished business.

A little over two weeks into the session, legislators have already signed a federal tax conformity bill including tax deductions for qualified higher education expenses and passed a health care reform bill in the Senate.

But issues from last year — like the failed bonding and tax bills — loom as legislators prepare to deal with a $1.4 billion budget surplus.

Here are some main topics to follow during this year’s legislative session:

Higher education

The University of Minnesota is lobbying the legislature for nearly $400 million in state funding this year, including a $147.2 million increase to its biennial budget and $245 million for capital projects.

These projects include $100 million for repair and maintenance of current campus buildings, $69.3 million for a Health Sciences Education Facility and about $23 million for a renovation of Pillsbury Hall.

But before receiving state funding, University officials will have to answer for the football team’s recent alleged sex assault scandal, said Rep. Bud Nornes, R-Fergus Falls, chair of the House higher education committee.

Senate Majority Leader Paul Gazelka, R-Nisswa, said the University will have to prove to lawmakers why it deserves a bump in funding.

Health care premium relief

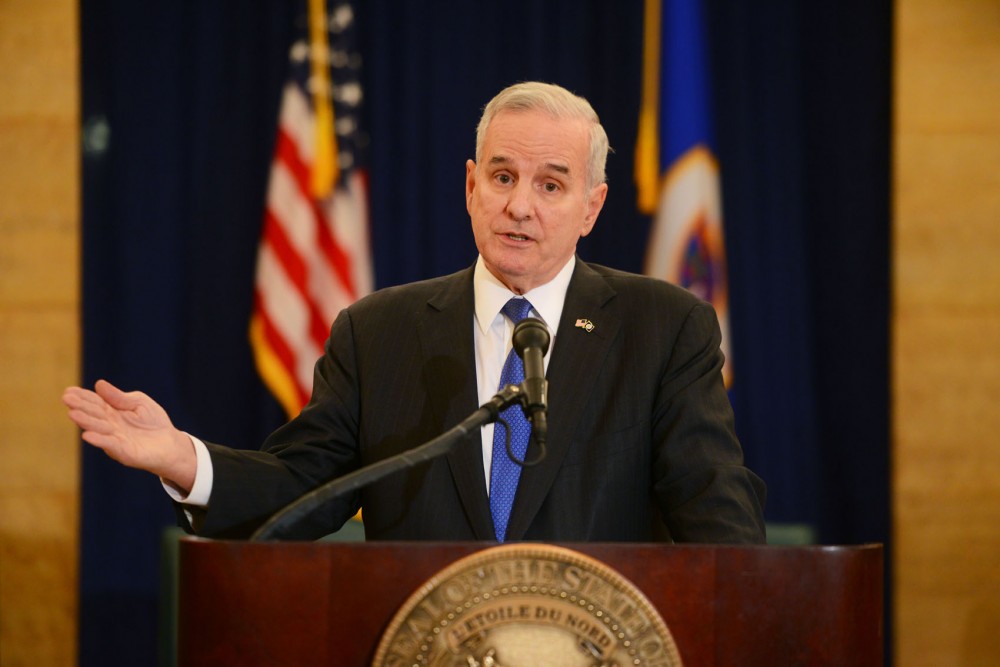

Gov. Mark Dayton and legislative leaders started talks in recent months to agree on a special session to pass a health care premium relief bill. They were unable to establish terms or hold a special session.

Because of this, relief for Minnesotans with rising health insurance premiums has been a priority in the early weeks of the 2017 legislative session.

State lawmakers in the Senate have already passed a health care premium relief bill, Gazelka said, and now await approval of the House version.

“The premium relief is the first part of it, providing emergency aid for those who had premiums go up as much as 67 percent,” he said.

Passing a bill would mark the beginning of reforming the state’s healthcare system, Gazelka said, although more reforms would be worked on “for years to come.”

Still, legislators were warned by Minnesota Management and Budget that relief wouldn’t be available until 2018 for qualifying residents under the Republicans’ current plan.

Dayton would likely veto the present form of the health care reform bill, said Sen. Richard Cohen, DFL-St. Paul.

Bonding

Lawmakers failed to pass a roughly $1 billion bonding bill for statewide infrastructure funding in the final minutes of last year’s session.

On Jan. 4, Dayton and Lt. Gov. Tina Smith introduced a new $1.5 billion bonding bill that would provide funding for state infrastructure projects and create an estimated 22,950 jobs.

Under Dayton’s bonding proposal, the University would be granted funding to help maintain campus buildings and build a new health science education facility.

Gazelka said he expects a potential bonding bill this year to perform differently from last year’s since there are 21 new lawmakers in the Senate.

Although it’s a budget year, he said he still expects a bonding package to pass before the session ends.

Sen. Kari Dziedzic, DFL-Minneapolis, said she’s heard a different tone from House Republicans on the bonding bill.

Some legislators want to focus on the budget and worry about bonding next year, she said.

Taxes

Federal tax conformity became the first law passed this year when Gov. Dayton signed it last week.

The state will now conform to new tax code changes, including cuts for qualified higher education expenses like tuition, mortgage insurance premiums and classroom expenses.

The new tax conformity bill is different than last year’s omnibus tax bill, which Dayton vetoed over a one-word error.

The $257 million tax bill — which included student loan tax credits and expanded childcare and veteran tax credits — is also expected to be revived this session.

Transportation

Road and bridge repair is another topic carried over from last session.

State transportation department officials have said Minnesota will need an estimated $16 billion for infrastructure fixes over the next 20 years.

One of the repair projects is the 10th Avenue Bridge, featured in a bill recently introduced by Dziedzic.

Funding was originally slated for the project in last year’s failed bonding bill, she said.

“Now we’re asking for about $30 million, and that will hopefully extend the life of the bridge for another 50 years,” Dziedzic said.

The total price tag of repairing the bridge is around $42 million, she said, but “it’s a lot cheaper than building a whole new bridge.”