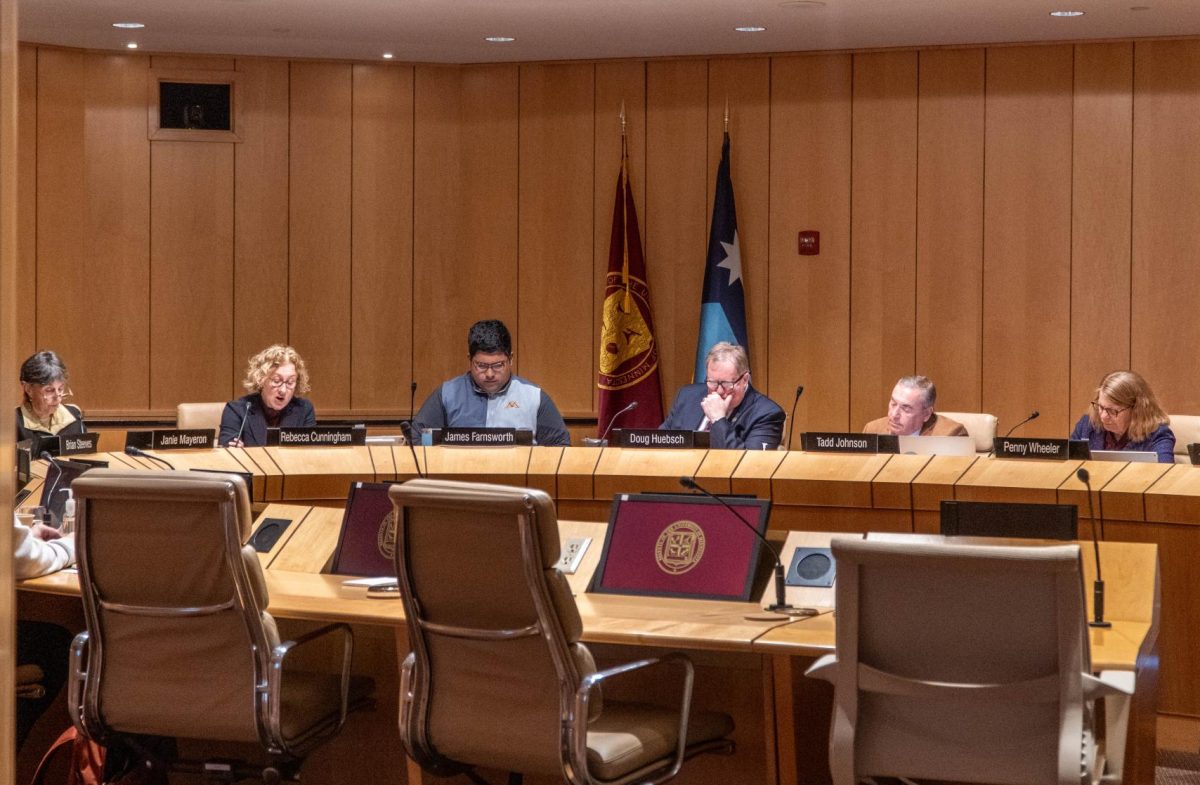

The University of Minnesota introduced Myron Frans as the new senior vice president for finance and operations last month, prompting a discussion among the Board of Regents about the cost of administrator salaries within higher education.

In a discussion before Frans was officially appointed, the Board of Regents raised concerns about his annual compensation package, especially given the University’s financial insecurity due to the COVID-19 pandemic. Regents also expressed concern with the lack of consultation about Frans’ hire, a feeling student leaders echoed.

Regent Darrin Rosha was one administrator who voiced concern at the September meeting. Although he supported Frans’ selection for the position, Rosha said he feels the overall model of compensation is cause for concern and needs to be addressed.

“Boards like ours across the country have sat back and allowed ourselves to create this fictional market that ultimately leads to all of these students paying student loans into their 30s and 40s,” Rosha said. “So while you certainly can’t question a person’s desire to earn as much as they’re able to, the fact that the institution is offering … this type of compensation, it’s literally a question of morality.”

Frans will receive an annual salary of $399,000. This amount is subject to the 10% pay reduction taken by top administrators in July — an effort to cushion the financial blow of the pandemic. Frans will also receive additional deferred compensation ranging from $50,000 to $80,000 each year between 2022 and 2026.

This salary is 6% less than former Senior Vice President Brian Burnett earned.

Frans received approximately $158,000 in 2019 in his previous position working under Minnesota Gov. Tim Walz.

In an interview with the Daily, Frans commented on the concerns about his compensation and the disparity between his new salary with the University and what he earned previously while working for the state.

“I understand the concerns about higher education salaries, and it’s something that we need to look at — and obviously mine came in lower than my predecessors,” Frans said. “I would just say, some comparisons were made to the state salaries paid … for the comparable positions. My only comment is [state salaries] are woefully inadequate for the jobs that are required for those folks. I think the comparison doesn’t work that well.”

Rosha and several other board members also said they feel that higher education should be viewed as a public service rather than a private business and that compensation models should reflect this purpose.

“When I came back to the board in 2015, the two things that had grown exponentially were administrative salaries and tuition. Everything else sort of follows the standard trajectory: faculty salaries and other costs are sort of in line with what you would expect from an inflationary standpoint,” Rosha said. “But administrative salaries and tuition had gone up dramatically.”

Other board members supported the appointment and salary, saying that in order to attract potential candidates to the University, salaries need to remain competitive with peer institutions.

“The salary is in line with what other people are getting from around the country. He’s making less than his predecessor. [The decision] wasn’t unanimous, but I think it was a strong support,” Regent Richard Beeson said.

According to materials from the September meeting, an annual salary of $354,700 falls in the 25th percentile of similar positions nationwide. The 50th percentile is marked by a salary of $407,800 each year.

Frans, who replaced predecessor Burnett, was approached by University President Joan Gabel about the senior vice president position. Addressing the financial implications of the COVID-19 pandemic is a major focus of the position, Gabel said in an interview with the Minnesota Daily.

“Myron Frans, through his work … has a very unique set of experiences that are very aligned with what the University is going to need for the next several years,” Gabel said. “He has repeated experience successfully and consultatively taking institutions out of deficit and stabilizing them financially. We are not in a deficit, but we don’t want to go into a deficit.”