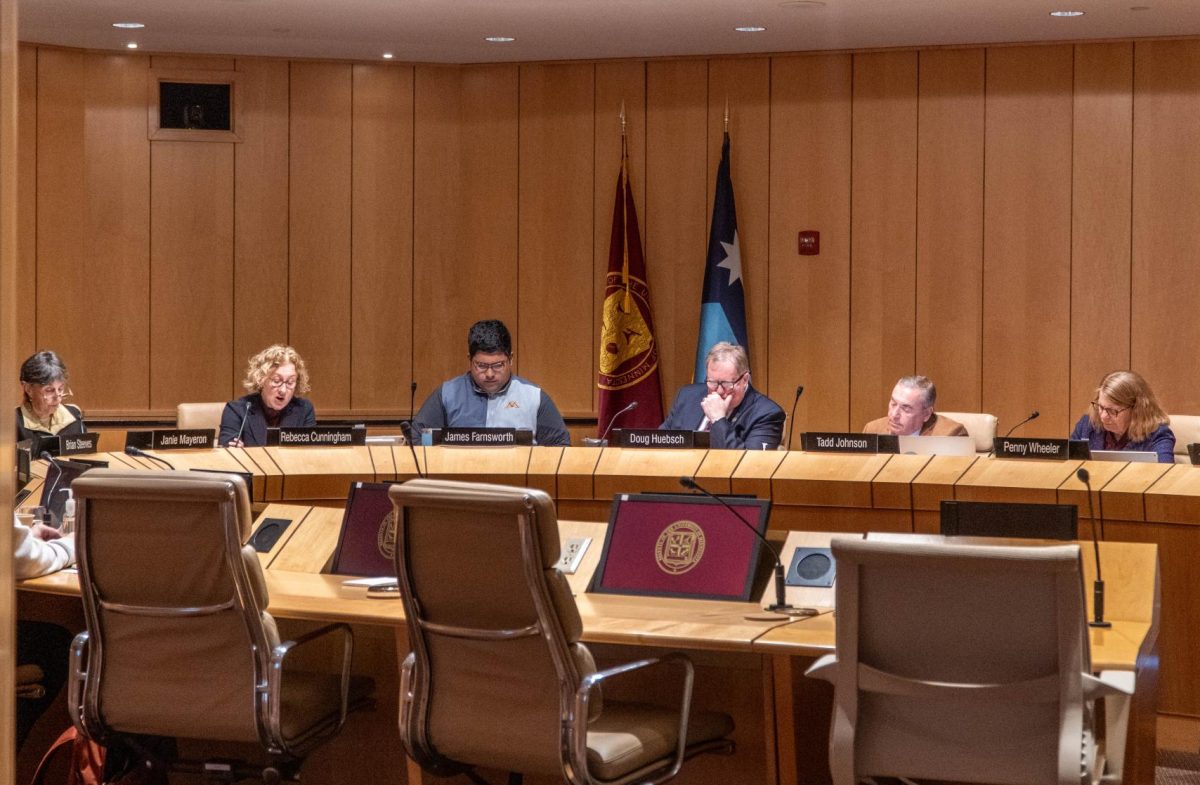

University of Minnesota Board of Regents Chair Janie Mayeron brought forward a potential policy adopting “institutional neutrality” regarding the University’s consolidated endowment fund Wednesday.

The potential policy would set a precedent that the University will not make investment decisions on social and political matters outside of the University’s control, Mayeron said. Board policy currently uses an environmental, social & governance (ESG) framework for investing to align with the University’s mission and values, which would interact with the new policy if passed.

Listening to the University community and better understanding the endowment’s function with the University’s mission are two of the most important priorities in the conversation, Mayeron said.

“We have learned that our University community is divided on the topic of divestment,” Mayeron said. “And that even if it were not, the feasibility of doing divestments in this current financial environment is complicated, and I would say nearly impossible.”

At the previous Board of Regents meeting on June 13 and 14, there was a work session where Chief Investment Officer Andrew Parks and Associate Secretary of the Office of the Board of Regents Jason Langworthy explained the University’s consolidated endowment fund and the history of divestment at the University.

The endowment is worth approximately $2.3 billion as of March 31 and uses third-party fund managers to manage 98.3% of the endowment.

The fund managers run the endowment by investing in selected companies. The funds are then used to support core University missions including research, fellowships and scholarships.

Selling certain pieces of the endowment could impact returns as it would affect holdings in a larger number of companies, Mayeron said. She added she has concerns about how endowment changes could impact costs for students and revenue streams.

According to Mayeron, after the previous work session, the Board sees divestment as largely symbolic with no meaningful impact on companies or federal and international policy.

Regents Bo Thao-Urabe and Mike Kenyanya said they had questions about how this potential new policy will impact the current ESG framework for socially responsible investment.

“If we take this position without clear frameworks for engagement it just feels like we have not truly engaged in good faith,” Thao-Urabe said.

Regent Robin Gulley said she worked on efforts to divest the University from genocide in Darfur, South Sudan when she studied at the University.

“It was one of the things I was most proud of as a student,” Gulley said.

Divestment from one university can create a domino effect, where other institutions may follow and have a real impact, Gulley said.

Gulley said taking a neutral stance is convenient, but this policy would show the Board will not listen to students when called to take a moral stance.

“I am deeply disturbed by the idea that that’s the kind of message that we want to send to our students a month after we told them that we would really consider divestment,” Gulley said.

The policy was discussed because several regents expressed their interest, Mayeron said in an interview with the Minnesota Daily.

“I think the next step is to absorb what we heard and figure out what the next step should be,” Mayeron said.

President Rebecca Cunningham said she appreciates the respect and dialogue of students on campus in their activism, but the Board also needs to consider safety and welfare on campus for the fall.

The Board has not made an official decision on the policy.

KG

Jul 14, 2024 at 11:37 am

Considering an institutionally neutral approach to investments is encouraging and certainly a step in the right direction. It would go a long way toward defusing the tense campus atmosphere. The July 10 Board of Regents meeting as reported was wide-ranging. But let’s not forget the elephant in the room. Let’s recall that the Israel divestment poll question in the March campus-wide elections managed support from barely 10% of the total student body. Do the Regents really want its economic policy (and income) to be guided by the whims of a few misguided students? Israel divestment is not even a moral. It is immoral. It incentivizes pro-terrorist, extreme pro-Palestinians who want to undermine a freely elected democratic government in Israel. The divestment intention is to deprive Israel of the tools it needs to defend itself and, ultimately, to cleanse Israel ethnically of Jews. Divestment is simply October 7, 2023 by other means. That’s the date that Hamas-terrorists crossed the border into Israel and wiped out whole Israeli villages–torturing, raping, burning, and murdering 1,200 mostly civilians (including Arabs and Moslems) and kidnapping 250 others. That is the face of real genocide. No, Israel does not commit genocide. Israel has no policy to murder Palestinians and never had. The only reason that divestment has surfaced again is because the UMN campus was criminally occupied and studies disrupted by a small group of students, radical faculty and non-students. So, let’s take remove divestment from the discussion. Let’s make the campus a little safer and more welcoming than it has been over the last few months. Hopefully, the dialogue will be more civil.

Susan Spiegel Pastin

Jul 12, 2024 at 6:14 pm

I understand divestment can be complicated, but I was glad to see a Regent fought for divestment against genocide back when she was a student!

I’m Jewish (BS 1968 and ex-Minnesota Daily reporter) and I support Israel – but NOT the West Bank Occupation or the genocidal way the Gaza War is being conducted. I favor a “Ben & Jerry’s Ice Cream” approach to DVS – DON’T disinvest from Israel completely, just from businesses involved in the Occupation.

But if the campus is divided on that for now, it would be understandable to punt for the short term.

But is there anyone who would support investing in, say, fossil fuel companies which are destroying our planet? Companies with horrible records on labor practices or massive deforestration?

Don’t abandon ESG! Do more research and have more discussion about what to do about Israel-Palestine.

Jerry Cohen

Jul 12, 2024 at 4:20 pm

Investment always requires being “called to take a moral stance. Consider, for example, investing in drug companies supporting capital punishment, oil companies lobbying for arctic drilling, tobacco companies that advertise to youth, drug companies that sell addictive opioids. An important role of a university it to set a high social standard, for education yes, but also to model social behavior and ethical standards. If the BofR wants to hide from these responsible positions they again fail to see their own role in protecting intellectual excellence.

seriously?

Jul 12, 2024 at 9:55 am

“institutional neutrality” is an oxymoron